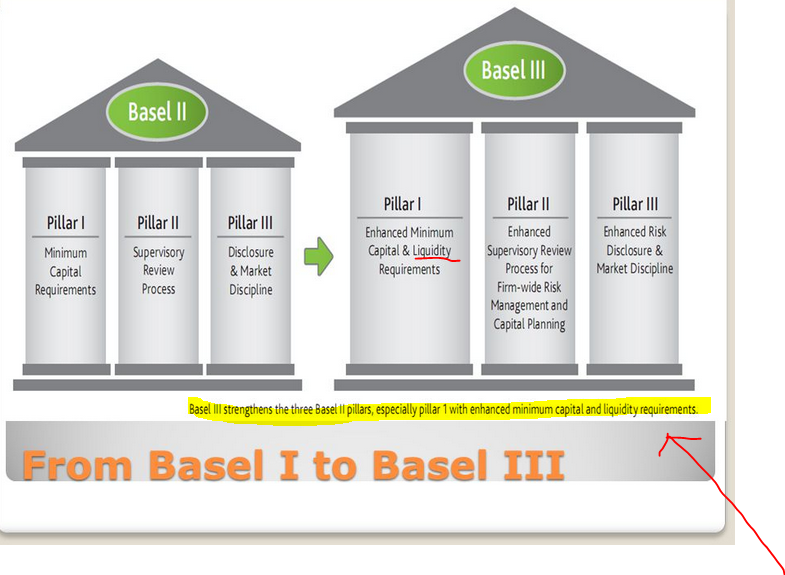

Bâle 3 : les ratios de liquidité vont-ils changer le business model bancaire traditionnel ? - BankObserver - BankObserver

Architecture de Bâle III Les nouveautés de Bâle III se présentent, en... | Download Scientific Diagram

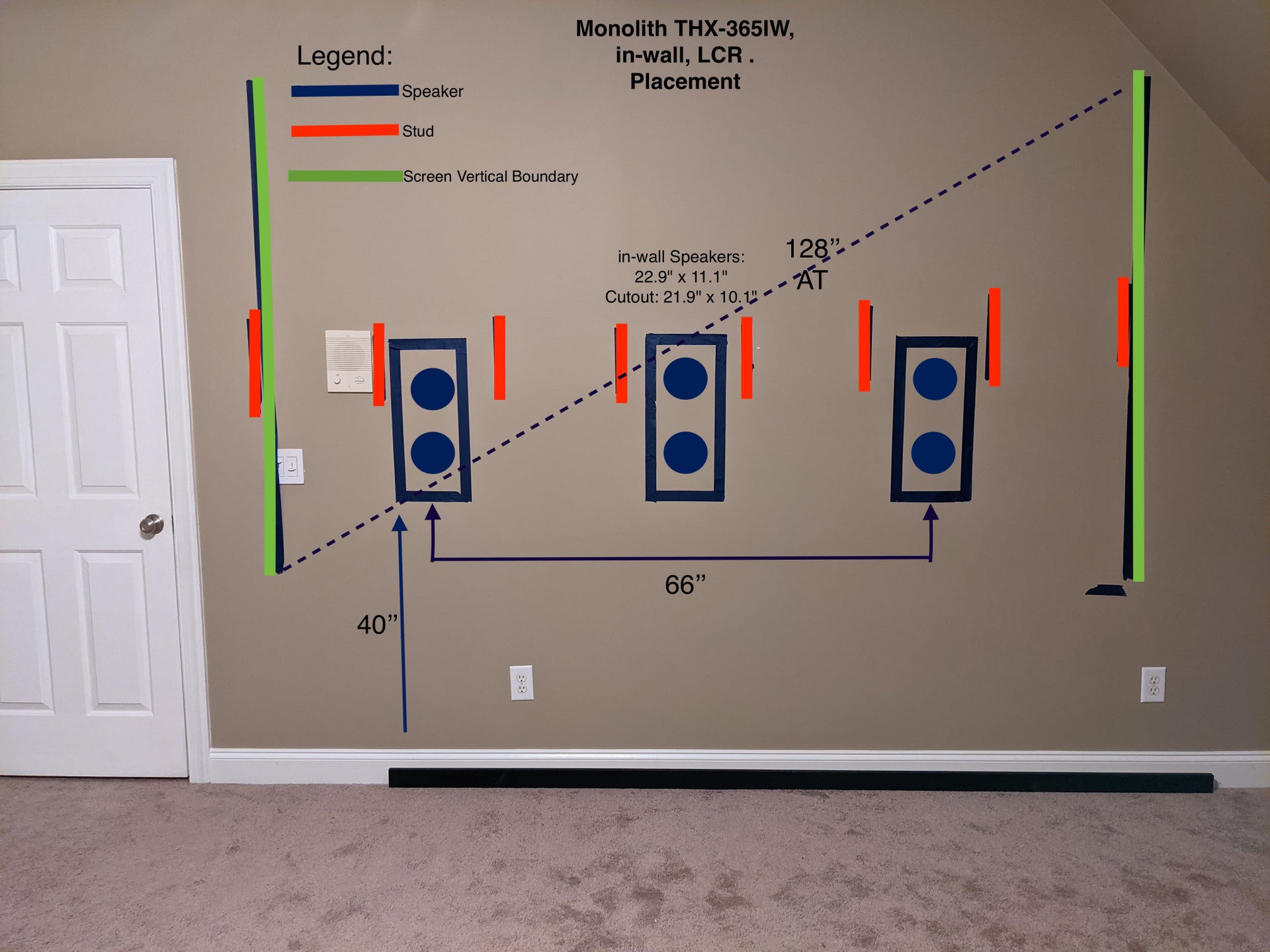

Impact of the Liquidity Coverage Ratio (LCR) Requirement on EMEAP Money Markets, Central Bank Operations and Monetary Policy Tra

![PDF] An Empirical Study on the Impact of Basel III Standards on Banks' Default Risk: The Case of Luxembourg | Semantic Scholar PDF] An Empirical Study on the Impact of Basel III Standards on Banks' Default Risk: The Case of Luxembourg | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7e36302fc1ec52e980eccf4cb3a095969f191118/9-Table1-1.png)

PDF] An Empirical Study on the Impact of Basel III Standards on Banks' Default Risk: The Case of Luxembourg | Semantic Scholar

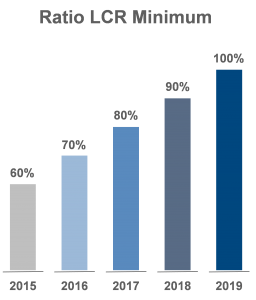

Consultant fonctionnel - reporting réglementaire Bâle 3 / ratios de liquidité LCR/NSFR | eFinancialCareers

What is the Liquidity Capital Ratio and how did Westpac get it so wrong? | by Damien Minter | Medium

:max_bytes(150000):strip_icc()/liquidity-coverage-ratio_final_2-fcb28a55d81d4ec8a679dbc8c93a9f24.jpg)