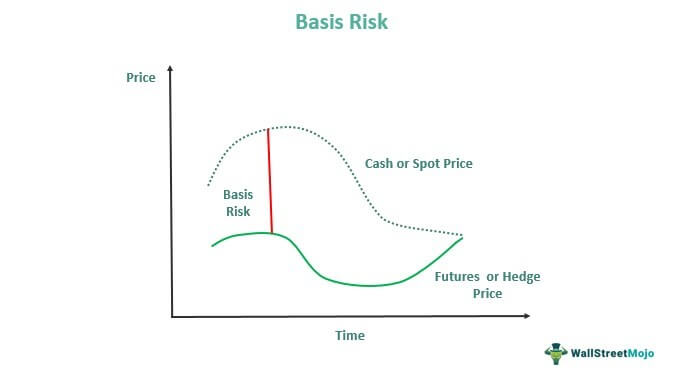

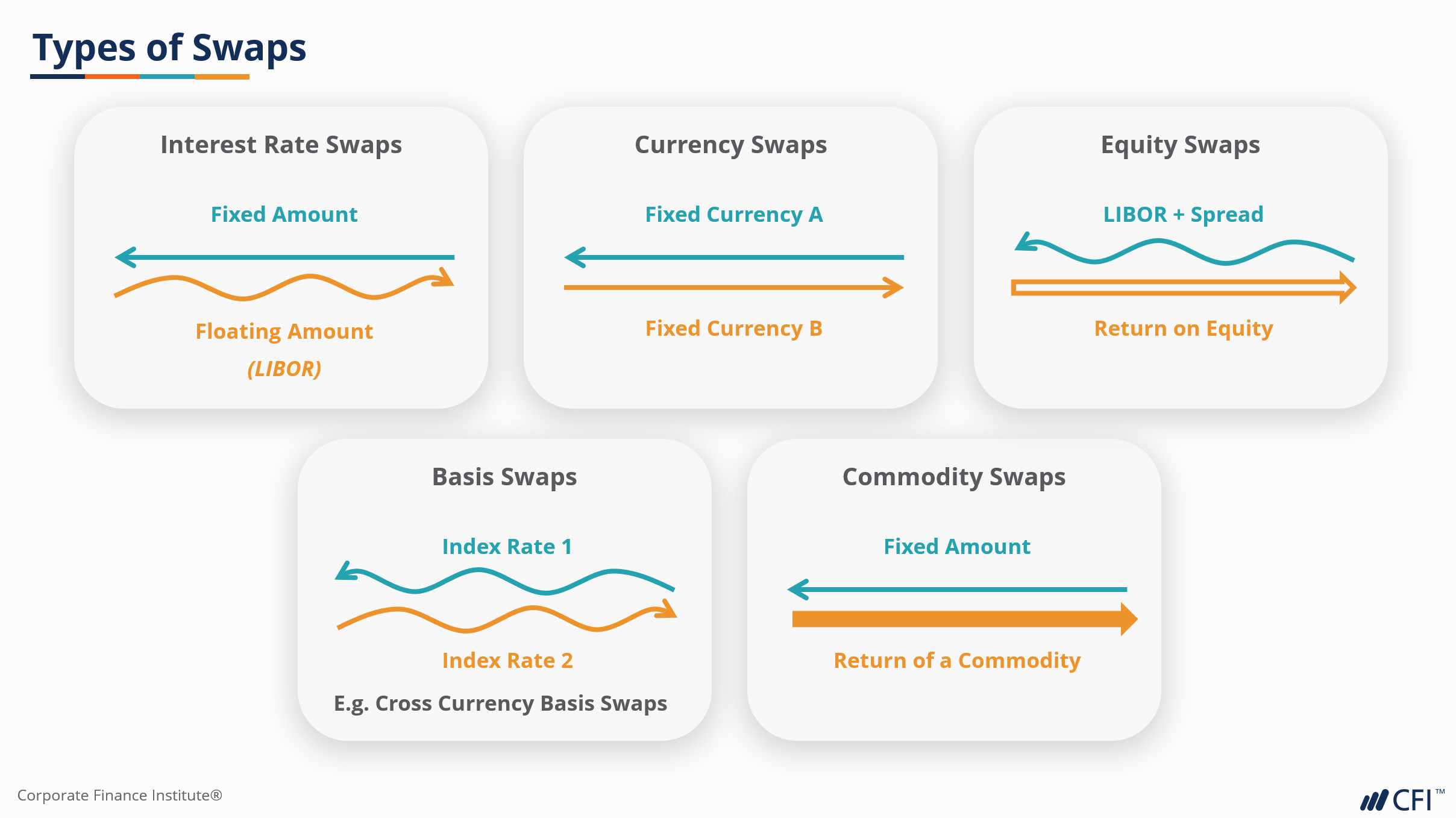

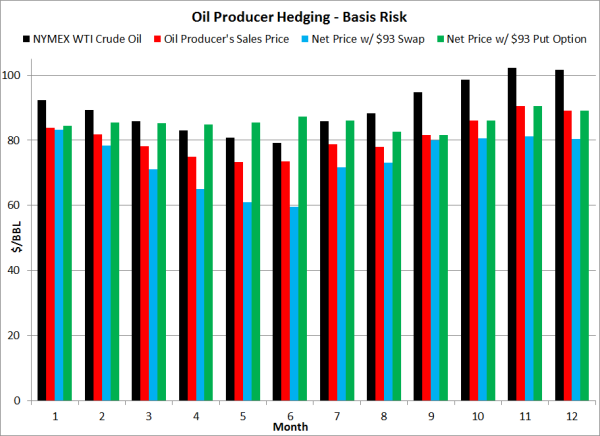

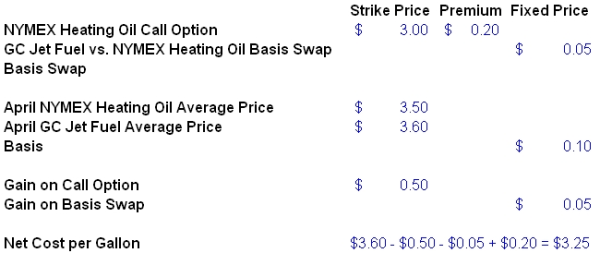

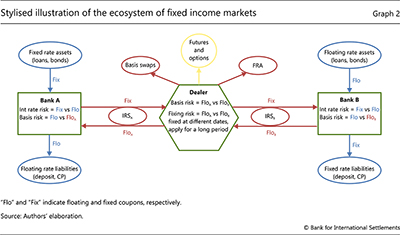

SOLVED: all are either basis, credit or sovereign <Back to Assignment Attempts: Average:/1 4.Risk in interest rate swaps Use the following table to determine which type of swap market risk each example

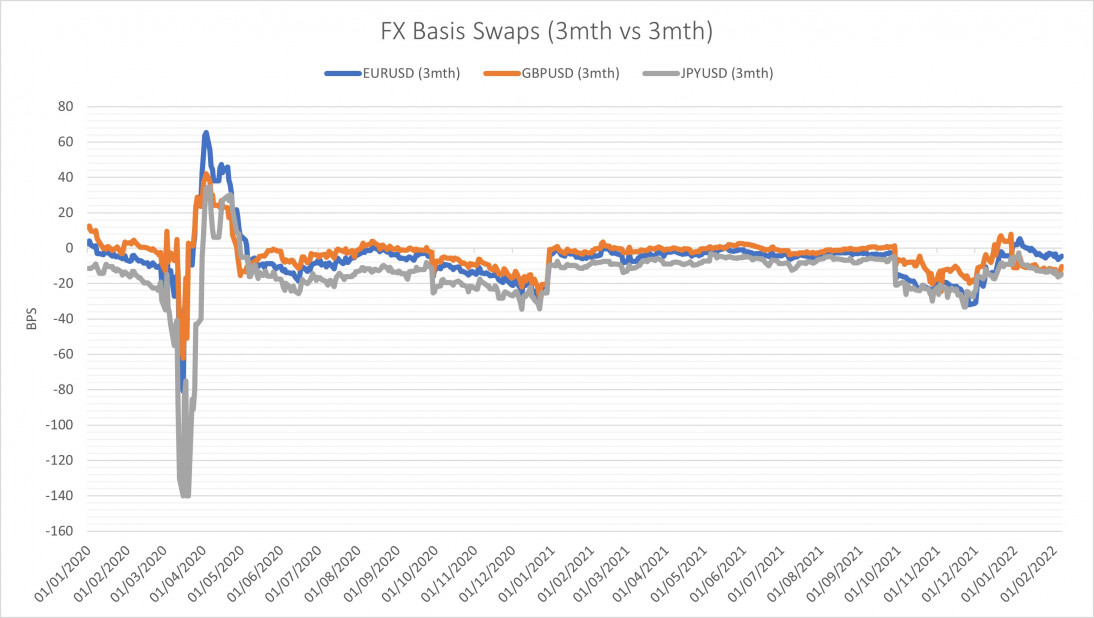

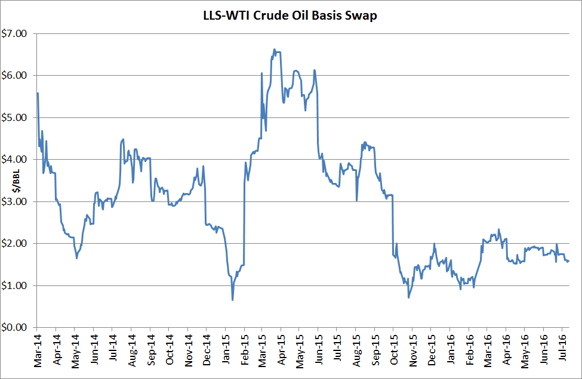

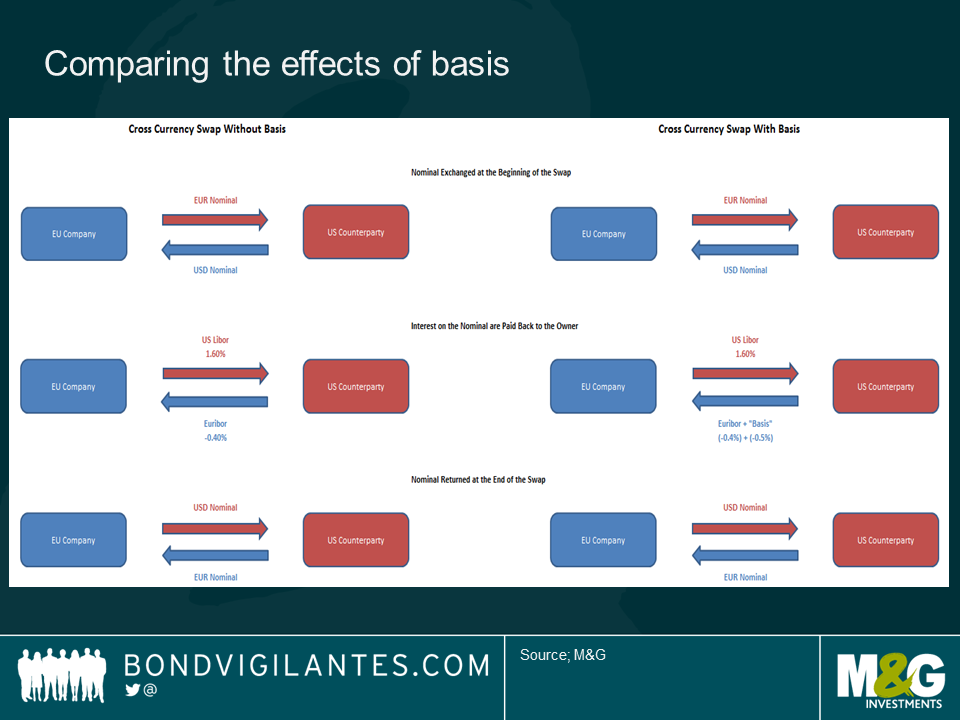

Building in Excel the Implied Risk-Free Discounting Curve when the Collateral is kept in another Currency. Example: Mexico, where no Local OIS Market exists. - Resources