Measuring long run stock returns using Cumulative Average returns (CAR) and Buy and Hold Average Returns (BHAR). Can ultimate answers be same? | ResearchGate

Changes in Equity Returns and Volatility across Different Australian Industries Following the Recent Terrorist Attacks. Introduction Data & Methods Empirical. - ppt download

Measuring long run stock returns using Cumulative Average returns (CAR) and Buy and Hold Average Returns (BHAR). Can ultimate answers be same? | ResearchGate

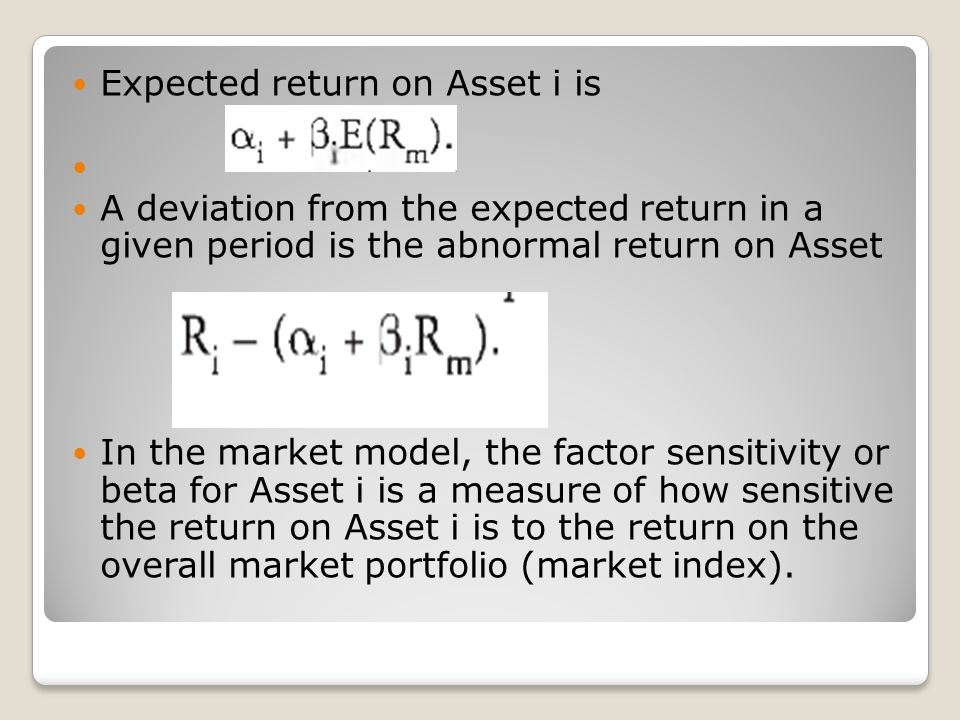

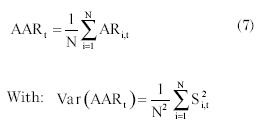

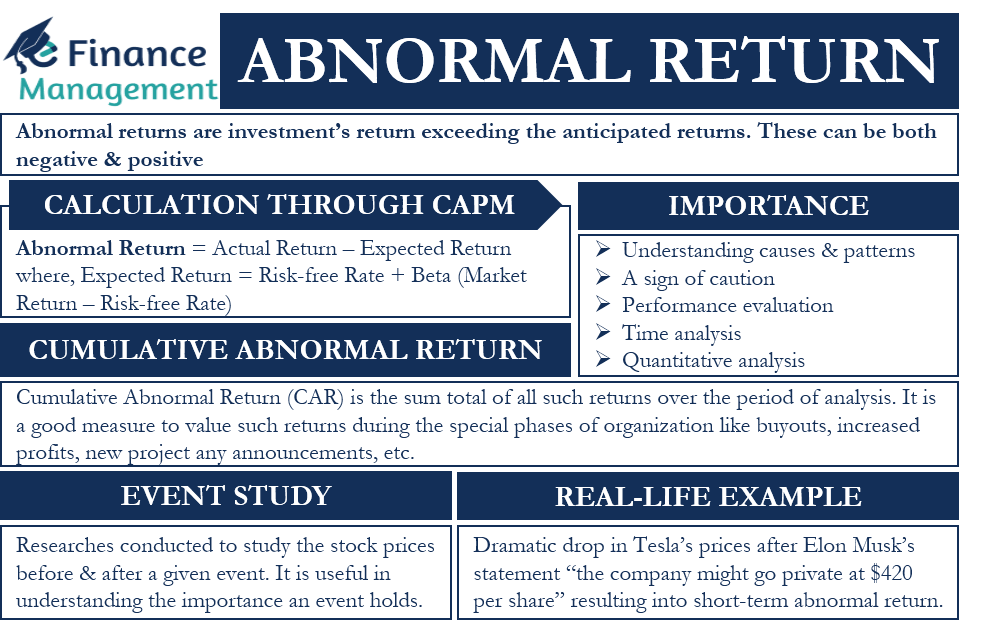

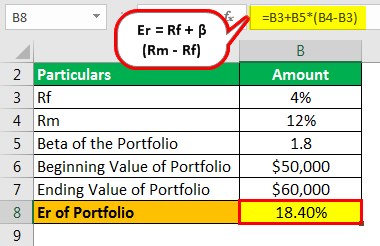

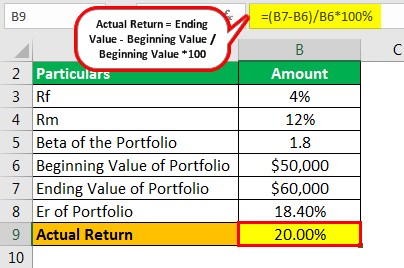

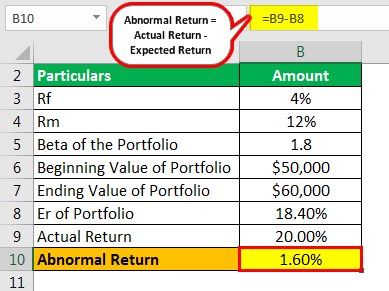

A pedagogical Excel application of cumulative abnormal returns to Hewlett-Packard Company's takeover of 3Com Corporation

finance - How to calculate the BHAR (Buy-and-Hold Abnormal Returns)? - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)